Back Alış üçün opsion Azerbaijani Kaufoption German Opción de compra Spanish اختیار خرید Persian Call French कॉल ऑप्शन Hindi Call opcija Croatian Kaupréttarsamningur Icelandic Opzione call Italian Kjøpsopsjon NB

This article needs additional citations for verification. (October 2011) |

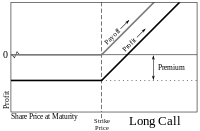

In finance, a call option, often simply labeled a "call", is a contract between the buyer and the seller of the call option to exchange a security at a set price.[1] The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at or before a certain time (the expiration date) for a certain price (the strike price). This effectively gives the owner a long position in the given asset.[2] The seller (or "writer") is obliged to sell the commodity or financial instrument to the buyer if the buyer so decides. This effectively gives the seller a short position in the given asset. The buyer pays a fee (called a premium) for this right. The term "call" comes from the fact that the owner has the right to "call the stock away" from the seller.

- ^ O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 288. ISBN 0-13-063085-3.

{{cite book}}: CS1 maint: location (link) - ^ Natenberg, Sheldon (1994). Option volatility and pricing strategies : advanced trading techniques for professionals ([2nd ed., updated and exp.] ed.). New York: McGraw-Hill. ISBN 0-585-13166-X. OCLC 44962925.