Back صندوق الإنقاذ المالي الأوروبي Arabic Европейски фонд за финансова стабилност Bulgarian Fons Europeu d'Estabilitat Financera Catalan Evropský nástroj finanční stability Czech Europäische Finanzstabilisierungsfazilität German Ευρωπαϊκό Ταμείο Χρηματοπιστωτικής Σταθερότητας Greek Tuteŭropa Financa Stabiliga Fonduso Esperanto Fondo Europeo de Estabilidad Financiera Spanish Euroopan rahoitusvakausväline Finnish Fonds européen de stabilité financière French

| This article is part of a series on |

|

|---|

|

|

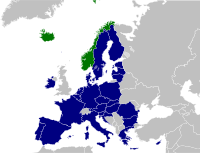

The European Financial Stability Facility (EFSF) is a special purpose vehicle financed by members of the eurozone to address the European sovereign-debt crisis. It was agreed by the Council of the European Union[a][1] on 9 May 2010, with the objective of preserving financial stability in Europe by providing financial assistance to eurozone states in economic difficulty.[2] The Facility's headquarters are in Luxembourg City,[3] as are those of the European Stability Mechanism.[4] Treasury management services and administrative support are provided to the Facility by the European Investment Bank through a service level contract.[5] Since the establishment of the European Stability Mechanism, the activities of the EFSF are carried out by the ESM.[6]

The EFSF is authorised to borrow up to €440 billion,[7] of which €250 billion remained available after the Irish and Portuguese bailout.[8] A separate entity, the European Financial Stabilisation Mechanism (EFSM), a programme reliant upon funds raised on the financial markets and guaranteed by the European Commission using the budget of the European Union as collateral, has the authority to raise up to €60 billion.

Cite error: There are <ref group=lower-alpha> tags or {{efn}} templates on this page, but the references will not show without a {{reflist|group=lower-alpha}} template or {{notelist}} template (see the help page).

- ^ "Extraordinary Council meeting Economic and Financial Affairs" (PDF) (Press release). Brussels: Council of the European Union. 10 May 2010. 9596/10 (Presse 108). Archived (PDF) from the original on 20 December 2021. Retrieved 7 July 2016.

The Council and the member states decided on a comprehensive package of measures to preserve financial stability in Europe, including a European financial stabilisation mechanism, with a total volume of up to EUR 500 billion.

- ^ Economist.com Archived 20 December 2021 at the Wayback Machine "European Financial Stability Facility, the special-purpose vehicle (SPV) set up to support ailing euro-zone countries, is even being run by a former hedgie. But this is one fund that will never short its investments."

- ^ Etat.lu Archived 20 December 2021 at the Wayback Machine "Articles of Incorporation of the EFSF established as a public limited liability company under the laws of the Grand-Duchy of Luxembourg.

- ^ Böll, Sven; Hawranek, Dietmar; Hesse, Martin; Jung, Alexander; Neubacher, Alexander; Reiermann, Christian; Sauga, Michael; Schult, Christoph; Seith, Anne (25 June 2012). "Imagining the Unthinkable The Disastrous Consequences of a Euro Crash". Der Spiegel. Translated by Sultan, Christopher. Archived from the original on 20 December 2021. Retrieved 26 June 2012.

- ^ "Limited services provision role for EIB in European Financial Stability Facility". Eib.europa.eu. 21 May 2010. Archived from the original on 15 March 2012. Retrieved 18 May 2012.

- ^ "Organisation". ESFS. Retrieved 26 January 2013.

- ^ Jolly, David (5 January 2011). "Irish Bailout Begins as Europe Sells Billions in Bonds". The New York Times. Archived from the original on 20 December 2021. Retrieved 24 February 2017.

- ^ "Merkel lobt Italiens Sparkurs und will ESM rasch befüllen". Der Standard. 11 January 2012. Archived from the original on 13 January 2012. Retrieved 12 January 2012.