Back Finansiële staat Afrikaans بيان مالي Arabic Maliyyə hesabatı Azerbaijani Фінансавая справаздачнасць Byelorussian Финансов отчет Bulgarian আর্থিক প্রতিবেদন Bengali/Bangla Finansijski izvještaj BS Estats financers Catalan Účetní závěrka Czech Jahresabschluss German

| Part of a series on |

| Accounting |

|---|

|

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity.

Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements[1][2] accompanied by a management discussion and analysis:[3]

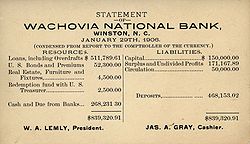

- A balance sheet reports on a company's assets, liabilities, and owners equity at a given point in time.

- An income statement reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period.

- A statement of changes in equity reports on the changes in equity of the company over a stated period.

- A cash flow statement reports on a company's cash flow activities, particularly its operating, investing and financing activities over a stated period.

Notably, a balance sheet represents a snapshot in time, whereas the income statement, the statement of changes in equity, and the cash flow statement each represent activities over an accounting period. By understanding the key functional statements within the balance sheet, business owners and financial professionals can make informed decisions that drive growth and stability.

- ^ "Beginners' Guide to Financial Statement". Securities and Exchange Commission. 4 February 2007.

- ^ Donald Kieso; Jerry Weygandt; Terry Warfield (2022). "1.1 - Financial Reporting Environment". Intermediate Accounting (18 ed.). John Wiley & Sons. p. 1-3. ISBN 978-1-119-79097-6.

financial statements (income statement, statement of owners' (stockholders') equity, balance sheet, and statement of cash flows) are the principal means that a company uses to assess its financial performance.

- ^ "Presentation of Financial Statements" Standard IAS 1, International Accounting Standards Board. Accessed 24 June 2007.