Back BTW Afrikaans Mehrwertsteuer ALS ضريبة القيمة المضافة Arabic Əlavə dəyər vergisi Azerbaijani Өҫтәмә ҡиммәткә һалым Bashkir Падатак на дададзеную вартасць Byelorussian Падатак на дададзеную вартасьць BE-X-OLD Данък върху добавената стойност Bulgarian মূল্য সংযোজন কর Bengali/Bangla Taos war ar gwerzh ouzhpennet Breton

| Part of a series on |

| Taxation |

|---|

|

| An aspect of fiscal policy |

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)), is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions.

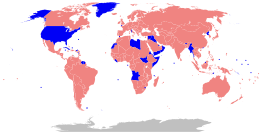

Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the producer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD).[1]: 14 As of June 2023, 175[2] of the 193 countries with UN membership employ a VAT, including all OECD members except the United States.[1]: 14

- ^ a b Consumption Tax Trends 2018: VAT/GST and excise rates, trends and policy issues. Secretary-General of the OECD. 2018. doi:10.1787/ctt-2018-en. ISBN 978-92-64-22394-3. S2CID 239487087. Retrieved 24 September 2016.

- ^ Asquith, Richard (6 June 2023). "How many countries have VAT or GST? 175". VATCalc. Tax Agile. Retrieved 15 August 2023.